Intel has been in the news lately, and I was reminded of the classic quote (and book) from Andy Grove, the past CEO of Intel — “Only the paranoid survive.” Grove speaks about Strategic Inflection Points when businesses face existential change, and how he applied his mantra about paranoia to navigate turbulence and keep Intel in a leadership position. Today feels like one of those moments when there is a confluence of monumental changes occurring. Tariffs and supply chain disruptions are colliding with the explosive rise of AI. At the same time we are witnessing chaotic swings in government policy and norms, and the advent of government intervention and forced investment in key industries. All of it is leading to economic uncertainty for companies big and small.

If ever there was a strategic inflection point, this is one of them. Grove tells us that when a strategic inflection point hits, we have to be prepared to throw out the rule book, but he also acknowledges that these can be moments to win new markets, thrive, and strengthen a business. The critical advice is to pay attention to the ecosystem surrounding your business, and be ever paranoid about which changes have the potential to emerge as inflection points.

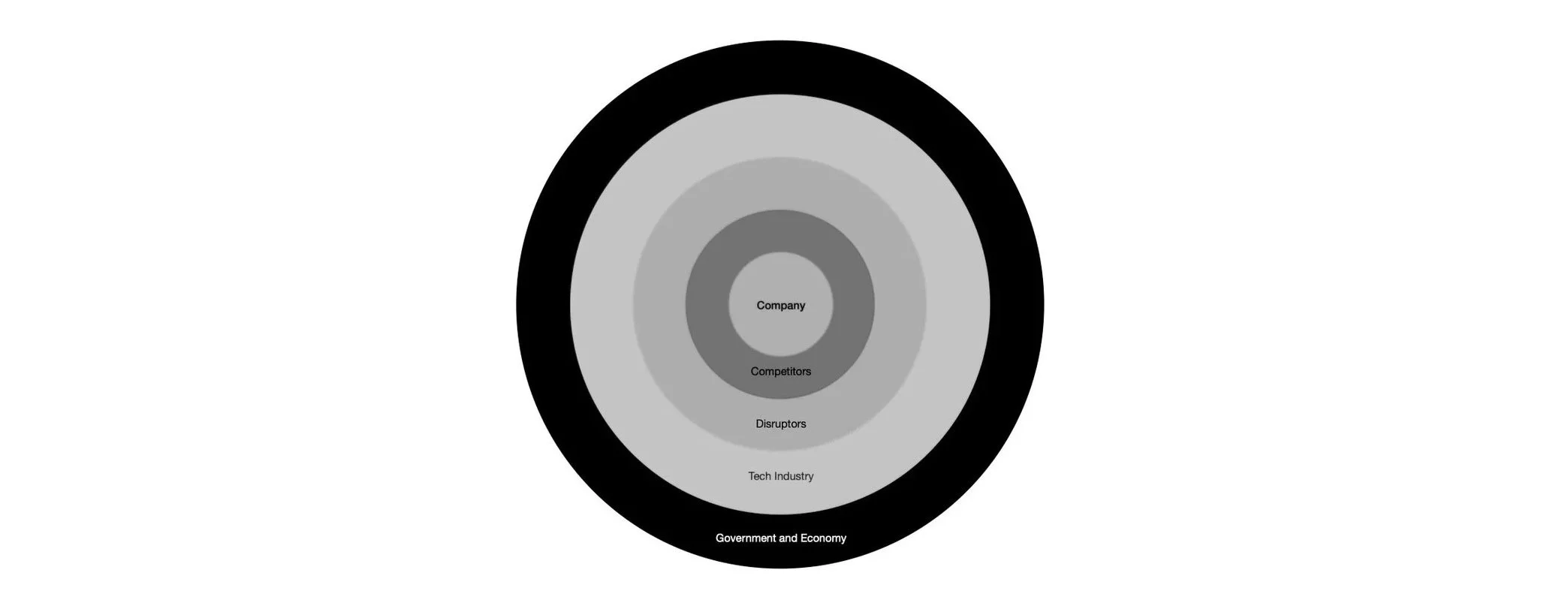

I started to think about how to operationalize that paranoia. Threats come from many directions. Some are easy to spot or obviously significant, but others may be subtle or slow moving, so easy to ignore. We need a model to organize the threat vectors and help us think about the threats in a systematic manner. I suggest we categorize threats by source, and determine a strategy for monitoring and anticipating the impact from each vector. Think of the company as the bullseye of a threat target. Each ring of the target represents a threat source, and the further the ring is from the center bullseye the less control the company has.

Company - Our first source of paranoia should be threats within our own four walls. Things like policy changes, reorganizations, hiring, firing, staff turnover, project delays, and customer issues can all introduce threats. Years ago, Intel released a chip that was intended to be the future of the company, but it had a math flaw that almost sank the company instead. It was a strategic inflection point that originated within the company.

Competitors - Gathering intelligence about each competitor is critical. Competitors are out to get you, so you have to remain hyper-vigilant about their go to market posture, their product direction, and any changes in their corporate structure, staffing, funding and ownership. Most companies are pretty bad at keeping secrets, so it is not that hard to figure out what your competition is up to. Even when you are clearly on top, fear your competitors and have healthy paranoia about what they are doing to defeat you.

Disruptors - In most markets, traditional competitors all tend to solve customer problems in similar ways. This is what defines a product category, and buyers become familiar with the feature checklists they expect from each competitor. Disruptors change the game. They rethink the problem and innovate completely new solutions. For example, AI-based chat solutions are disrupting traditional search engines, or how the iPhone completely disrupted the mobile phone industry. Disruptors do not generally spring onto the market fully functional and competitive. They lurk on the periphery of the market while they mature, and then launch with a splash and gain rapid acceptance. Paranoia about disruptors requires curiosity and an open mind. It is easy to dismiss a newcomer as a non-competitor. If you are paranoid, you will listen to their pitch through the lens of a prospect, and be open to their innovative solution, even if it does not fit your mold for how to address the market.

Tech industry - This is a broad category, but generally being aware of changes and breakthroughs in the industry, and having a healthy paranoia about how they may impact your business is critical. Examples of tectonic changes that bankrupted many companies include the shift from on-premises to cloud computing, the shift from traditional procedural coding to service-based rapid development tools, the shift from perpetual licenses to recurring revenue licenses, the shift to mobile-first apps from hosted applications, and of course, the biggest of all is the rise of AI in every aspect of the tech world.

Government and Economy - This is the last broad category that has recently become quite unpredictable. As an example of how this category can threaten a business, I recently spoke with a Governance, Risk, and Compliance (GRC) software company that focuses on foreign corrupt practices reporting. The U.S. administration lifted compliance requirements and suddenly this software company’s business evaporated. The same can be said of products for DEI tracking as the emphasis on DEI policies has come under attack. Economic uncertainty and tariff pressures, or elimination of government funding can all create a chilling effect on corporate purchasing that translates into stalled sales cycles. Seemingly remote actions are worthy of paranoia to avoid a crippling adverse strategic inflection point.

So how do we translate awareness of the threat vectors into an operational model? First, we need a strategy for monitoring each vector. I suggest assigning a person or a small team to each ring of the bullseye or vector, and formalizing the process of monitoring and reviewing threats. Schedule formal periodic reviews of what they find. Carve out time during existing meetings to hear the latest finds. The frequency of review may be slower for each concentric circle radiating from the center. For example, internal threats may require weekly review, and can be addressed in routine staff meetings. Competitive threats may fit into monthly meetings. Industry and disruptor items can be reviewed quarterly, and government / economic items may fit into a semi-annual strategy meeting. The important element is to make time for the team to hear and discuss the threats, and to be sufficiently paranoid about them.

The most common tool for presenting threats has been a SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats), but this does not go far enough to adequately address the need. The three missing components are Time, Probability, and Magnitude. When we see a threat, we need to assess the timing of its impact, the probability of it occurring, and the magnitude of its impact if it occurs. Armed with these additional elements, we can prioritize our need to respond — low probability events that will not happen soon can be prioritized lower than near-term events with high probability. Threats with high existential magnitude require greater attention than low magnitude threats.

We also need to assess the opportunities presented by the events we see on the horizon. We can respond to a threat by running away, or we can respond by reinventing our business to benefit from the threat. Sometimes known as a ‘pivot,’ many companies have responded to threatening changes in the market and emerged much stronger. The mantra should be to obsolete yourself before someone else does it for you. When assessing our potential responses, our analysis needs to include similar elements of Time to respond, Probability of success, and Magnitude of cost and impact on the business.

Putting it all together, we need to designate a person or team to be our “Office of Paranoia” specifically tasked with monitoring the threat vectors. They need to periodically report their findings in a formal manner. Their assessment must answer the ‘so what’ questions that will provide us with Timing, Probability, and Magnitude so we can determine how to respond to the threat. As a team, we need to listen with a paranoid but open mind, and be prepared to act.