I was always a believer in a bright, bold line that separates operational management from the role of the board. As a CEO, I felt that my job was to run the company, and the board’s role was to provide strategic guidance and counsel. If the board did not approve of the way I ran the company, they could remove me. I resisted was the board trying to “help” me by diving into operations.

After multiple CEO positions, and multiple boards, I have mellowed a bit, and developed a more nuanced perspective on the board and CEO relationship. I still believe in a line of demarcation, but it has faded and become fuzzy. After some pretty bad board experiences, I started to study the dynamics of the relationship between the board and the CEO, and how to leverage the board as a weapon. I had a pretty good idea of what did not work, so my goal was to figure out what would work.

One of the first things I realized was that board composition is a huge determinant of building a successful relationship. In venture and private equity backed companies, the board is typically stacked with investors. There is a power dynamic as a result of the CEO working ‘for’ the board, but in a healthy relationship, the parties collaborate and the CEO works ‘with’ the board. Defining what it means to work together is a critical element of building a healthy relationship. For some investors, the model is “it’s our money, so we get to tell you what to do.” There are very successful investors for which this is exactly the formula. They have a playbook, and if they invest, then they call all the shots. There are CEOs for whom this is just fine. There are other investors that believe in ‘bet the jockey’ and look to the CEO to chart a successful path. There are CEOs that relish this autonomy. However, if there is a mismatch of investor type and CEO type, things never go well, so figuring out that dynamic is critical for a positive board/CEO relationship.

Being able to spot a good investment does not necessarily make someone a good board member. However, institutional investors have the benefit of seeing multiple similar businesses. They have been to the movie before, and their pattern recognition tells them how it will turn out. An effective institutional investor will translate their pattern recognition into constructive input for the CEO and allow for the possibility that the CEO may also have experiences and see alternative patterns. This is where a collaborative relationship is vital.

The CEO is much closer to the business than the board, and they typically have a much more nuanced perspective. It is incumbent upon the CEO to effectively communicate the salient facts and background to the board, so they can be informed and helpful. For board members, it is vital that they listen and understand the nuances before jumping in with superficial opinions. The rule should be ‘Ask then tell’ not ‘Tell then ask.’ Listen to what is really going on, ask what the management team is already doing about it. Consider the ideas that have already been tried. Then, and only then, if you still have something to add, tell management your opinion. Too often, I have seen board members hear a few facts and immediately start to pontificate about what management needs to do. All too often, it is exactly what management is already doing, and the exchange is insulting to management’s professionalism. Viewing the board dynamic as a collaborative relationship, and recognizing that the CEO and the board members are all professionals with a common goal to drive for success is critical for a positive relationship.

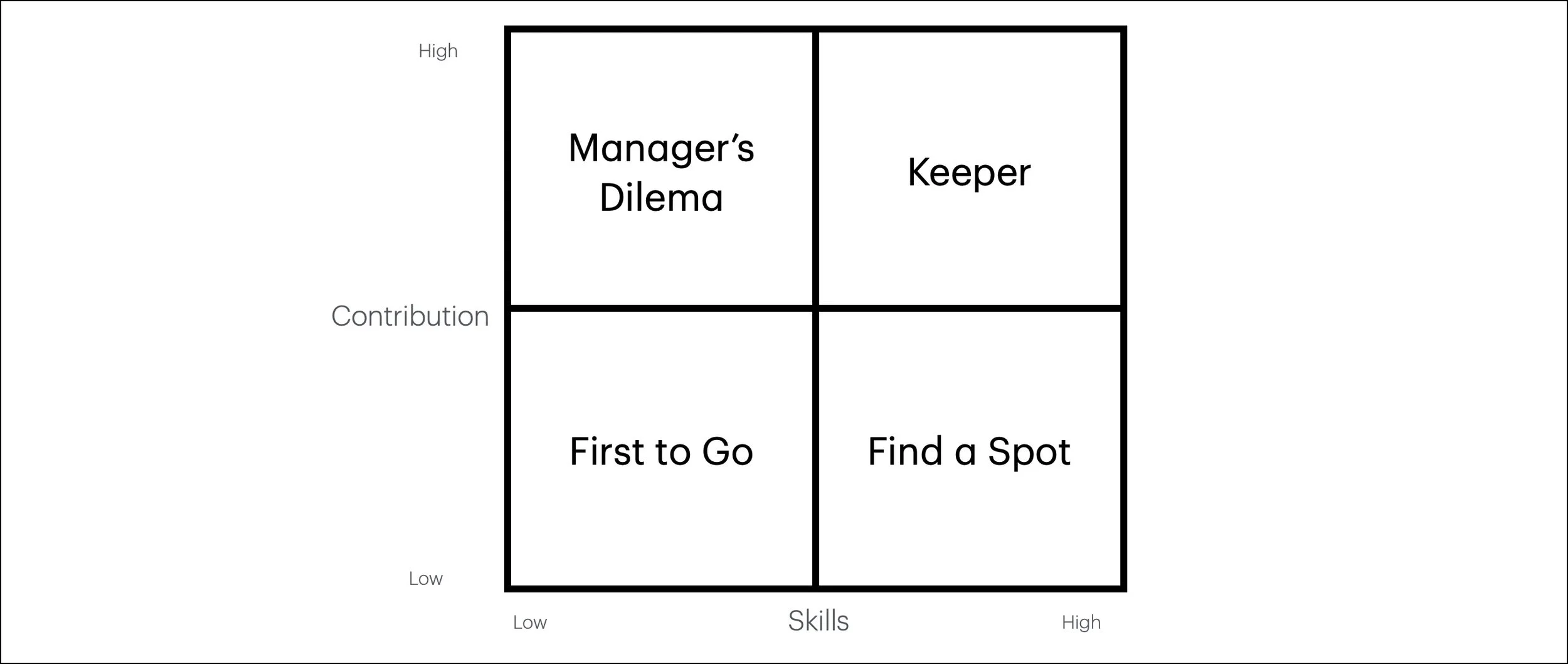

An effective board can become a competitive weapon. It makes the company better. But, board composition needs to be carefully curated to ensure the right collection of expertise and personalities and relationships. VC and PE investors have a responsibility to keep an eye on their money, but that does not mean they are automatically the most valuable board members. Investment documents grant board seats without much thought as to who will actually fill the seat and whether they will become a weapon for the company or a distraction. It is more of an investor policy matter - if we invest, we get a seat. This is a wrong-minded approach. Investors should put people on the board with the skills and the obligation to add value regardless of whether they are investor partners or just smart people.

Creating a board that is a competitive weapon requires an honest assessment of corporate needs. Some companies need help with internal operations, while others need help with entering markets, or engineering a financial path. Board members with specific expertise can turbocharge the business. They can be helpful to guide executives, or share experiences, or open doors that will help the company mature. Figure out what the company needs, and then go find the best person to bring that skill to the board.

The most important thing for a board member to realize is that their role is not passive. A board meeting should not be management putting on a show with board members in the audience. For the board to be a weapon, they have to join the fight and actually contribute. Investor board members need to have self-awareness to differentiate when they are just watching versus when they are contributing. If they are just watching, then they should become observers and relinquish the seat to someone who will actually get in the game and help.

Non-executive, independent board members play an important role. When curating the composition of a board, the independents can be the most valuable elements of building a competitive weapon. Choose wisely, and know precisely what role an independent will play. Clearly articulate and discuss what the CEO and other board members are expecting of the independents.

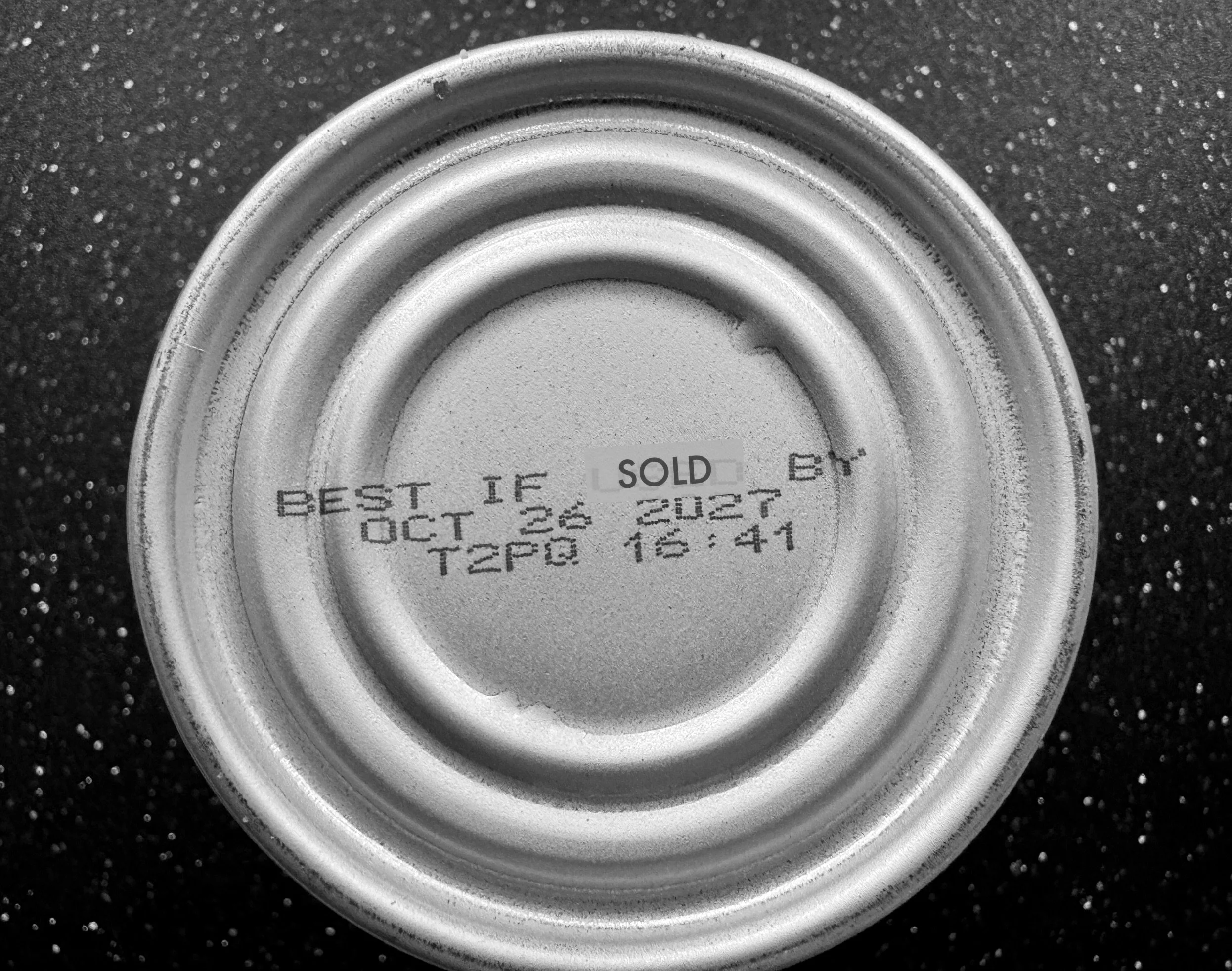

Lastly, keep in mind that companies mature and evolve, and the contribution the company needs from the board will change over time. Set board terms, and be thoughtful about extending a board member’s term of service - even for investor board seats. The CEO should be able to have a conversation about the current investor participant, and the opportunity to request a new member. It may be awkward, but so is failure or mediocre performance. Force the board to be the competitive weapon the company deserves.